Beauty industry - main development trends

Hair, makeup and skin care: for billions of people around the world, beauty products and services are an important part of how they look to themselves and others. The beauty industry's slogans "Because you're worth it!" and "Making life more beautiful" promise to improve not only people's appearance, but also their lives.

As in many other industries, the pandemic has changed consumer preferences and behavior. However, the beauty industry has been one of the most heavily affected market segments. And where dynamic changes occur, there is always room for new business ideas and new startups. In this review, we will look at this area and tell you about the new trends we have discovered.

The beauty industry, which includes skin care, color cosmetics, hair care, fragrances and personal care, had a tough year in 2020, with color cosmetics sales falling 33% worldwide, while overall retail sales in the beauty category fell 15%. But the industry has been resilient in the past, and experts predict return to growth in 2022.

The process of recovery and development of the industry is characterized by the following trends:

- the number of new players in the industry is growing,

- there is a shift in customer preferences towards specialized products and services

- new advanced products, procedures and services are emerging

- Companies are paying increasing attention to interactions with consumers in the process of choosing, purchasing and using cosmetic products and services

The pandemic has accelerated the development of once fringe technologies, from virtual try-on features to AI-powered skincare analysis and “waterless” beauty products. The industry’s sustainability and focus on environmental impact have become important factors in shaping consumer behavior. Major beauty players, such as L’Oréal and Estée Lauder, have included carbon neutrality in their strategies to appeal to eco-conscious consumers. Other companies have begun experimenting with innovations in reusable packaging and waterless beauty products. The production and use of synthetic ingredients in beauty products is also gaining attention.

The largest cosmetics companies actively invest in the development of start-ups, since it is often easier to support the development of new companies that can become potential partners or acquisitions in the future, instead of developing their own innovations. Plus, it is known that independent brands are more confident in achieving success in those areas that large companies cannot cope with due to internal inertia. This is especially true for market niches and innovative methods of promotion in social networks.

Having assessed the success of independent venture companies such as the vertically integrated incubator Seed Beauty, from which successful companies emerged, such as ColourPop And Kylie Cosmetics, large cosmetic corporations followed their example, creating their own incubators and accelerators. Sephora Accelerate has been investing in and supporting female founders since 2016, growing brands such as an organic beauty line LXMI and a premium essential oils brand Vitruvi.

Cosmetics conglomerate L'Oréal offers various internal initiatives such as the Open Innovation Program , Women in Digital program, L'Oréal's Technology Incubator and the launch of L'Oréal's corporate venture fund BOLD. Target also has its own accelerator program for startups Target TakeoffAmong its graduates is a gender-neutral makeup line. Fluid And Mented Cosmetics, which offers makeup for people of color. Seed Phytonutrients from L'Oréal and Skinsei from Unilever are just a few examples of brands created within the company.

The beauty industry attracts venture capital firms and business angels all over the world. Startups that create innovations in this industry are attractive targets for investment, mergers and acquisitions. There are three main reasons for such investments:

1) The desire to stay on trend

2) Transition to new technologies

3) Testing new business models

I will list some interesting deals. L'Oréal acquired natural skincare brand Thayers in June 2020. .

Inter Parfums, Inc. announcedthat its subsidiary Interparfums SA (“IPSA”) and Divabox, owner of the Origines-Parfums e-commerce platform for beauty products, have signed a strategic cooperation and investment agreement under which IPSA will acquire 25% of Divabox’s capital.

Henkel Company acquired controlling stake in a marketing platform Invincible Brands, which owns local cosmetic brands HelloBody, Banana Beauty And Mermaid+Me.

Coty also is actively expanding portfolio through the acquisition of innovative companies. After purchasing 51% shares Kylie Cosmetics for $600 million in 2019, it acquired 20% shares of Kim Kardashian's cosmetics business, KKW Beauty, for $200 million in June 2020. Coty later rebranded both cosmetics lines

In February 2021, Estée Lauder increased its share in the company Deciem and plans to acquire the rest of the company within 3 years.

Today, with the explosion of incubators, accelerators, the growth of e-commerce channels, and the rise of direct sales, there are unprecedented opportunities for beauty startups. Acquiring young startups helps optimize resources and reduce the risks of innovation, thereby increasing the efficiency of their businesses. Industry bigwigs are looking for independent brands to experiment in new markets and test emerging trends. Own incubators provide conglomerates with the opportunity to deeply understand these companies, acquire a stake in their business, and ultimately pave the way for future acquisitions, since the incubator already reveals which early-stage brands will mature and which will cease to exist.

While personalization is not a new trend, beauty brands continue to embrace new technologies and improve the way they engage with consumers. From customized lipstick shades to customized hair care systems, the range of personalized formulas for consumers is growing. Research Forrester found that 77% consumers chose, recommended, or paid more for a brand that provided a personalized service or experience, while Accenture found that 75% consumers were more likely to make a purchase when recommendations matched their specific characteristics.

Most online shopping companies help their customers find the right cosmetic product for their individual needs by using a series of screening questions that probe customer preferences and suggest products based on the results. The use of screening question algorithms is particularly common in the fast-growing direct-to-consumer (D2C) market. An example is Function of Beauty in the USA, Bare Anatomy in India, Medulla in Japan.

Customized products are another type of product personalization. For example, MAC Shanghai prints 3D printed eyeshadow palettes for clients, and Shespoke developed software that enables the mass production of individually tailored lipsticks.

Artificial intelligence is another innovation that offers great opportunities for companies to create personalized offers, especially in areas such as skin care. For example, the company Proven uses its collected databases of over 100,000 products, over 8 million reviews, and over 4,000 scientific publications to train its artificial intelligence systems. As a result, the company is able to offer users recommendations on the most effective ingredients for their case. The company Atolla also uses artificial intelligence to personalize the facial serums it produces (adjusting the oil, moisture, and pH levels in cosmetics). To train the AI, it uses data collected through systems of screening questions and tests, which are then processed by the company's algorithm.

Another interesting way to ensure product personalization are home devices designed to detect individual user characteristics, which can measure the state of the customer's appearance, such as the appearance of dark spots under the eyes, the presence of age spots or wrinkles. eg L'Oréal released a device called Perso. Preso is powered by artificial intelligence and allows you to select and apply personalized skin care products, lipstick, and foundation. The Perso app collects data about the user's skin condition and environmental conditions using an uploaded selfie and location data.

Preso App Demo

Much more research and development is needed before companies can rely solely on AI designers. But AI is already helping brands design and produce new styles faster. In 2018, Tommy Hilfger announced a partnership with IBM and the Fashion Institute of Technology. The project, known as “Reimagine Retail,” used IBM AI tools to decipher fashion industry trends in real time based on consumer preferences, runway photos, trending patterns, silhouettes, color schemes, and styles. The system’s findings were presented to designers, who used them to create their next collections.

Heuritech offers an AI platform that analyzes millions of images, identifying shades, cuts, shapes, and thousands of other fashion elements to predict how popular they will be in the coming year. For example, the system can predict the popularity of a particular color in the U.S. next season. Brands like Dior use Heuritech to validate their experts’ opinions on future fashion trends, and manufacturers like Wolverine Worldwide use it to gauge whether consumer demand for certain products is growing.

Machine learning can predict with some certainty what up to 80% of a seasonal collection will look like. And only for the remaining 20% is it necessary to develop new creative ideas. This leaves more time for the creative team to search for truly interesting and original fashion concepts.

Stitch Fix uses artificial intelligence to develop garments for its Hybrid Design line. The line is created by algorithms that identify trends and styles not found in Stitch Fix’s portfolio and suggest new designs — based on consumers’ color, pattern, and textile combinations — for designers to approve.

The company goes into detail about how it works (shown below) in "Algorithms Tour" on its website

The company said sales of AI-generated products are on par with those of fashion brands' suppliers, based on the fact that Stitch Fix has a wealth of customer data to feed its AI and the effective feedback loops that underpin its subscription business model.

An example of how an algorithm creates a new one based on two initial models.

Stitch Fix is one of the most interesting and fastest-growing retailers of the last decade. It’s an online personal styling service that uses AI algorithms and human stylists to recommend clothing, shoes, or accessories. The company sends customers a package containing five personalized outfits — ones that match their style, size, and price preferences. They can keep the package or send it back for free. Customers can then either continue to receive packages or directly order the items they receive recommendations for. It’s worth noting that Stitch Fix’s success isn’t just due to its machine “workforce.” Despite all the hype about AI, the company has found that the more humans it has involved in training its AI systems, the faster its customer base has grown. Stitch Fix has doubled the number of stylists it employs from 2017 to 2021. The company currently employs 5,000 stylists and about 150 data analysts..

With more rigorous human-guided training, AI programs will continue to evolve and become more accurate and efficient. The information they create will help companies make smarter strategic decisions about product development and new business directions.

AI technologies are used not only to determine general trends in fashion development, but also to create specific models of clothing and footwear based on them. In combination with 3D design platforms, such as, for example, CLO, companies create clothing designs in real time.

Scientists from the University of California, San Diego, in collaboration with Adobe, have proposed a method of using AI to study individual style and create personalized computer images of objects, which suit this style.

The researchers first trained a convolutional neural network (CNN) to classify user preferences for specific items. To do this, they fed the system shopping data taken from Amazon’s platform in six categories: shoes, tops, and pants for both women and men. The team then used this information to train a generative adversarial network (GAN), a type of AI that works particularly well at creating realistic images. A GAN is built from two networks trained using the same data set. One network generates images based on that data set, while the other network uses the same data to determine whether an image is real. This method allows the network to improve its performance. Based on this algorithm, each user receives multiple images of items that match their preferences.

Such a system, in addition to working with individual users, also provides companies with the opportunity to identify general trends in fashion development at a very early stage.

Company True Fit, for example, it partners with retailers to help its 180 million registered customers use AI to determine both the style and exact sizes of clothing when purchasing without physically trying them on.

Virtusize, another company capitalizing on the trend, allows online shoppers to choose the right size by either measuring their own clothes or comparing clothes from select brands and styles to their own. Virtusize claims that by eliminating size uncertainty, it can increase the average order value by 20% and reduce return purchases by 30%. The company’s clients include Balenciaga and Land’s End, as well as Zalora, a leading online fashion retailer in Asia.

The combination of AI, 3D scanning, augmented reality and computer graphics is ushering in the next era of fashion, which is personalization and prediction based on consumer preferences. As databases of customer preferences grow, algorithms will enable new fashion trends to be generated and predicted in ways that were not previously possible.

This trend is directly related to the development of production methods and communication methods that allow, in addition to mass production aimed at the largest consumer segments, to move on to servicing the so-called "long tail", that is, relatively small consumer groups with their own specific needs, thereby opening up broad opportunities for sales development. Based on this trend, the concept of inclusiveness was formed. Inclusive beauty is the acceptance of all people of all backgrounds, abilities, and appearances. Diverse and inclusive beauty is about making beauty accessible to all people, regardless of their race, body type, skin tone, gender, sexual identity, religion, age, or ability. Historically, the ideals of beauty and the beauty industry have been subject to a very limited and selective visual representation. The ideal image of “beauty,” as defined by the media and the beauty industry, was white women, tall, thin, with clear skin and a “feminine” appearance. There was a very clear idea of the set of ideals that women should strive to in order to be considered beautiful. And until recently, the beauty industry was dominated by the ideals of white skin, almost zero fat, and flawless, glowing skin. The idea of inclusivity rejects this standard of beauty and relies on broader principles that shape new markets. This includes the production of gender-neutral products, offering products in line with real-life beauty types and standards, and a positive attitude towards one’s appearance, no matter what its features.

Since launch Fenty Beauty In 2017, “inclusive beauty” became a buzzword in the industry, encompassing new demographics that are increasingly important to the beauty industry. For example, major retailers like Sephora, Macy’s, and Bluemercury made a commitment called the “15 Percent Pledge” — a promise to dedicate 15% of their shelf space to Black-owned businesses. Ulta Beauty also promised to double the number of Black-owned brands by the end of 2021, committing more than $25 million to the goal.

This trend continues to gain momentum. And it’s important to note that it’s important to distinguish between “niche” and “underserved” audiences, as there are many demographics with untapped potential.

Below, we will focus on the most significant segments that will largely determine the future of inclusive beauty.

COSMETICS FOR MEN

Over the past few decades, men's beauty offerings have expanded beyond face washes, moisturizers, and basic hygiene products to include eye creams, face masks, sunscreens, makeup, and more. Many modern brands, such as Stryx, Shakeup Cosmetics And War Paint, use a direct D2C sales channel and special packaging design to attract a new generation of male consumers.

The rapid development of the trend and the expansion of the relevant market segment is evidenced by the increased activity of mergers and acquisitions in it. Since Unilever acquired Dollar Shave Club for $ 1 billion in 2016, the number of investment deals in new brands of personal care products for men has increased sharply. For example, in September 2019, SC Johnson acquired brand of skin care products for men Oars + Alps for US$20 million. In September 2020, the company Edgewell acquired brand of men's cosmetics Cremo for $235 million.

According to recently published data Future Market Insights (FMI), the men's skin care market is valued at US$ 13,572.6 million in 2022 and is projected to reach US$ 28,344.8 million by 2029.

Growing interest among men in their health, body condition, self-care and hygiene is the main factor driving the growth of the men's personal care market. To meet the demand, major players such as P&G and Reckitt Benckiser have expanded their product range to include men's products. For example, Reckitt Benckiser's women's brand Veet launched its first men's personal care product in November 2019. expanded the range its products into men's grooming products, launching a hair removal cream for men, and announced plans to launch additional men's products in the near future.

New products that stand out from the competition attract more customers. One of the trendsetters in the field of cosmetics for men is South Korea. China is also one of the fastest growing markets for men's cosmetics.

Global brands are following this trend. Chanel, in particular, launched for the first time Chanel Boy in South Korea, while Shiseido said its men's cosmetics line demonstrated double-digit growth amid the pandemic's growth, fueled by Japanese businessmen in their 40s who needed to spend a lot of time on teleconferences.

GENDER NEUTRAL COSMETICS

Gender-neutral makeup lines are the next step in inclusive beauty as younger generations break down traditional gender norms and prejudices. More than half of Gen Z believe that gender is not binary and instead encompasses a spectrum of gender forms. Responding to this trend, companies are developing and releasing beauty products that are not targeted to a specific gender. Skincare brands from Aesop to Ursa Major And Non-Gender Specific have abandoned gender-specific marketing, choosing instead to package and sell unisex products that focus on specific skin concerns or conditions. In the makeup space, examples include Fenty And Milk Makeup , as well as startups such as Fluid And Jecca Blac .

Legacy brands including MAC Cosmetics, Tom Ford, Gucci and Marc Jacobs have also taken note of the trend and launched gender-neutral lines of cosmetics, fragrances and clothing.

Sam Cheow, senior vice president of corporate innovation and product development at The Estée Lauder Companies in an interview with Harper's Bazaar said: "From a cultural perspective, we understand that gender is no longer a fixed concept."

PEOPLE OF COLORED

While the beauty industry has received a lot of attention from consumers of color, there is still much work to be done in this area. In addition to Fenty, it is interesting to list a number of inclusivity-oriented brands, such as Mented Cosmetics, Urban Skin Rx And Live Tinted. All of them are actively developing relationships with major retail chains, including Ulta Beauty, Target and CVS.

To bridge the gap in traditional beauty products and serve underserved markets, leading corporations are turning to fast-growing startups founded by founders of color. Globally, Black consumers represent an estimated $1.3 trillion in purchasing power. In 2021, Black Americans spent an estimated $6.6 billion on beauty products. This represented $11.1% of the total U.S. beauty market, slightly behind the 12.4% Black share of the overall U.S. population. Black consumers have an affinity and preference for beauty brands that specialize in products for this segment and are 2.2 times more likely to find that these brands are the best fit for them. However, these specialty products account for only $4% to $7% of the shelves in beauty salons, drugstores, grocery stores, and department stores. (Source: McKinsey)

To tap into this massive market, leading industry giants are developing special programs for founders of color, including Glossier and L'Oréal's grants for Black-owned businesses and Sephora's recent accelerator cohort that included only founders of color.

Companies are also actively investing in specialized companies. Thus, at the end of 2018 P&G Acquires Walker & Company Brands. Walker & Co. is a beauty and wellness startup founded in 2013 by entrepreneur Tristan Walker. The company makes razors, trimmers, shaving kits, lotions, and grooming products for people of color. Its men's line, Bevel, is designed for men with coarse or curly hair, while its premium shampoo and grooming line, Form, is designed for women with textured hair.

The underrepresentation of products for people of color extends beyond product lines and communication channels. Black dermatologists make up only 3% of the profession in the U.S., which has a significant impact on the development of cosmetic products. Darker skin reacts differently to skin conditions like acne, eczema, and keloids, and is more susceptible to hyperpigmentation due to the higher amount of melanin. At the same time, most cosmetic products are tested on lighter skin tones, completely ignoring the effectiveness of products on people of other skin tones.

In November 2020, Unilever-owned Vaseline teamed up with actress Regina King and startup Hued launched the program Equitable Skincare for AllThe project offers additional training to dermatologists of color and provides a dermatology knowledge base for the general population of color.

BEAUTY FOR DIFFERENT GENERATIONS

There is a significant opportunity to address the needs of groups beyond the young adult segment (ages 18 to 35). Several brands specialize in this market segment. One of the age-related issues their products address is the physiological changes that accompany perimenopause and menopause. For example, the company AbsoluteJOI is a skincare brand that caters to women of color. Founder Ann Beal says her core customer group is women aged 40 and up. The company Pause Well-Aging focuses on menopausal skincare products that address concerns such as hot flashes, night sweats and loss of skin elasticity.

But it is not only people over 40 who stand out as a special target group. Cosmetics companies also see potential for development in the children's cosmetics segment. The company The Honest Company Jessica Alba, who started her business in the child care industry, recently went public, raising more than $412 million in funding.

Amyris Launches Baby Care Brand Pipette, and sells them both through its own online store and through Target retail stores in North America. Through its Lab-to-Market synthetic biology platform, Amyris develops and manufactures ingredients from naturally occurring sugar cane and a fermentation process. It uses these in its Pipette and Biossance beauty brands. Pipette baby products are 100% non-toxic, hypoallergenic, dermatologist- and ophthalmologist-tested, pediatrician-approved, and Environmental Working Group (EWG) verified, meaning their formulas meet the highest standards of health, safety, and wellness. Another young company making baby care products Mini Bloom started working in December 2020.

It should be noted that cosmetic companies producing premium products are also expanding their range by adding baby products to it. Companies Dr. Barbara Sturm And Chantecaille can serve as an example of this trend. Dr. Barbara Sturm, released her line Mini Molecular in April 2018 with five products that retail for between $38 and $65. A Net-a-Porte company began promoting children's beauty brands. Little Aurelia And Bamford .

And finally, cosmetics for teenagers. Generation Z is an important growing segment of the market. Brands targeting them, such as British Plenary And Bubble are on the rise. Chanel, YSL and others are rethinking their product strategies to attract younger shoppers. Social media plays a huge role in this segment. It is there that teenagers look for fashionable products that suit their needs. The company CeraVe , Elf Cosmetics And The Ordinary have risen in the rankings to become one of the best skincare brands for teens in 2021, thanks in large part to TikTok influencers. The Ordinary takes first place with over 37 million searches per year. In fact, it's well ahead of second-place Neutrogena, with just 7.85 million searches, and third-place Foreo, with 6.85 million.

Social media fame is an important asset and can be used as a basis for your own business. For example, TikTok influencers Nel Twins launched their own line of cosmetics in April 2020, and the D'Amelio family in collaboration with Morphe Cosmetics creates a line of makeup products.

K-beauty is a term for cosmetics imported from South Korea. It was introduced to the United States in 2011, when Sephora began selling Korean skincare brand Dr. Jart+. Since then, Korean cosmetics have been a consistent favorite among Western consumers.

But the beauty boom is not limited to K-beauty; other markets are turning heads with their own products inspired by their cultural heritage. This includes Asian beauty markets like China, which is a pioneer in virtual beauty thanks to its technological and social features. In recent years, beauty brands like Perfect Diary , Florasis And JudydollTheir growth has been fueled by a shift in demand towards local brands, the ability to leverage cultural ties and local manufacturing. Some Chinese brands claim the ability to launch new product lines in as little as three months.

C-beauty brands (Chinese brands) have also used partnerships to gain popularity outside of their local markets. In 2019, Perfect Diary ended its eyeshadow partnership with the Metropolitan Museum of Art and signed a brand promotion deal with Australian singer Troye Sivan. An interesting way of promotion was implemented by the company Zeesea, which released eyeshadow palettes in in collaboration with the British Museum. And the company Millet Pepper develops global sales through the Amazon platform and develops relationships with influencers in Europe.

Local brands are taking advantage of their deep local market knowledge and are rapidly growing sales in their regions. Indonesia, the country with the largest Muslim population in the world, is a booming market for halal cosmetics. Cosmetics and skincare brands such as Base, Esqa And Rose All Day, serve examples of successful Indonesian Halal Certified Brands.

Brazil is one of the world's fastest growing markets for cosmetics and personal care products. For example, cosmetic brand Sallve recently raised $21 million in funding.

Large cosmetics companies are also trying to enter local markets, especially in South Asia and Africa. In particular, in South Asia, the Pacific region, the Middle East and North Africa. L'Oréal is actively investing in the development of its business in these regions. It plans that the bulk of its new business over the next decade will come from these markets. The company will certainly be interested in cooperation with local brands, since these markets are very specific and require localization of the offered assortment.

The development of biotechnology is becoming an increasingly important factor in the production of cosmetic ingredients. Many consumers recognize that not all synthetic substances are harmful and are often a more environmentally friendly alternative to traditional products.

Synthetic substances also demonstrate advantages from a supply chain perspective. Mined or grown ingredients require a large number of suppliers, farms, and fisheries. Synthetic ingredients, on the other hand, are produced under more controlled conditions, ensuring greater consistency across the entire manufacturing process. And the process of growing ingredients in a lab reduces the destructive impact of farming, fishing, and mining on the environment.

Several brands are actively experimenting with biosynthetic ingredients. For example, Ginkgo BioWorks developed a process fermentation of genetically modified yeast to produce rose oil with new and unique aromas. The company does not use expensive rose petals.

Biotechnology company Geltor offers vegan collagen-based ingredients for the cosmetic and food industries. Startup C16 Biosciences uses fermentation to produce a sustainable alternative to palm oil. The company produces its own sustainable squalane (usually derived from shark liver) from vegetable oils (cottonseed, flaxseed, olive, argan, wheat germ and many others) and sugar cane. Squalane is an oil that instantly softens, moisturizes, soothes the skin and is an essential ingredient in the production of many cosmetic products. Synthetic squalane helps keep animals and plants alive.

Big, established conglomerates are also working in the same direction. Johnson & Johnson, maker of brands like Neutrogena and Aveeno, is investing in new synthetic preservatives that can be used in products like hair and body care. Through its incubator JLABS, the company has invested in Curie Co , a startup that produces biomaterials to replace preservatives in everyday cosmetics and personal care products. L'Oréal signed a license agreement with the company Micreos.

Micreos is a pioneer in antibacterial technologies designed to replace antibiotics. Based on a long-term collaboration with the Swiss Federal Institute of Technology (ETH) in Zurich, Micreos has developed first-in-class patented products and technologies that are considered true technological breakthroughs. Their products are currently marketed under the brand name Gladskin. Micreos Gladskin contains the endolysin Staphefekt SA.100. This drug selectively kills Staphylococcus aureus bacteria, including methicillin-resistant Staphylococcus aureus (MRSA), which is resistant to many antibiotics. S. aureus is now known to cause or aggravate many skin conditions, including eczema, acne, and rosacea. In March 2021, cosmetics conglomerate Coty entered into a partnership agreement with LanzaTechto use the biotech company's environmentally friendly ethanol in its fragrances.

With consumers increasingly choosing eco-friendly cosmetics, lab-grown synthetic ingredients are becoming a competitive advantage for cosmetics companies. Additionally, biosynthetic ingredients can mean cost savings for companies, including lower transportation costs, reduced supply chain risks, and reduced emissions.

Sustainability is a hot topic in almost every industry, but it has become especially acute in consumer packaging. The beauty and personal care industry produces about 120 billion pieces of packaging each year, and nearly 91% of those bottles, wrappers, and other plastic waste, made mostly from non-renewable materials, end up in oceans and landfills.

Consumers — especially millennials and Gen Z — are leading the way in ditching single-use plastics, according to McKinsey, up to 70% of U.S. consumers surveyed said they were willing to pay more for environmentally friendly packaging.

The shift is accelerating as government regulations in the EU and some US states push consumer goods companies to adopt greener alternatives.

Cosmetics conglomerates and independents are looking to use the trend to create competitive advantages. L'Oréal, Estée Lauder and Unilever have pledged to reduce their use of single-use packaging. A Pai Skincare And HiBar , reduce their use of virgin plastic or completely abandon it. The company Amyris, specializing in biotechnology, recently acquired a controlling stake shares of the eco-friendly cosmetics brand EcoFabulous — seventh brand clean cosmetics in its portfolio.

The shift to more sustainable packaging is also giving rise to new business models. One of the main trends in this area is the use of reusable packaging. This business model is developing in several verticals. For example, companies Myro And By Humankind allow users to refill their deodorant supplies, and Kjaer Weis And Asa Beauty extend this principle to other cosmetic products as well.

The ability to use reusable packaging is still a rarity in retail chains, but this area is one of the potentially interesting areas for business development. In March 2021, the Body Shop opened gas stations in its global network of stores. Consumers can now “fill up” on shower gels, hand soaps, shampoos and hair conditioners.

Chilean company Algramo offers an interesting solution for refilling household goods. Thanks to Algramo’s partnership with Unilever and Nestlé, cosmetics and personal care products may be the next step in the company’s business model. The company has created special equipment and a process that completely automates “refilling.” The user registers in the mobile application, deposits money into their personal account, goes to the vending machine with a “smart container” and collects a certain amount of the corresponding product, after which the money is debited from their account. “Algramo is at the forefront of a new way of shopping for various products; their high-tech refilling system optimizes the customer experience and meets the growing demand from customers for convenient, affordable and waste-free solutions,” — Bridget Croke says, a member of Algramo's board of directors and managing director of Closed Loop Partners, which represents Algramo in the U.S., "We see a lot of demand for this solution."

Another area is the collection of used packaging for recycling. MAC Cosmetics and Lush, pioneers in this area, invite consumers to return empty containers in exchange for free products. And this trend continues to grow. In April 2021, Lush launched a program Bring It Back in Great Britain and Ireland.

In 2019, waste recycling company TerraCycle launched a project Loop . Customers pay a refundable deposit for reusable containers, wash, refill with the appropriate product, and reuse. Upon return of the container, the deposit is returned to the customer's account. Company cooperates with several retailers including Ulta, Nordstrom, Tesco and Sainsbury's.

Biodegradable packaging is another trend that has long been popular in industries such as food and beverage. Neutrogena, for example, makes biodegradable wipes. Other alternatives include paper- and fiber-based packaging being developed by startups such as Paboco, Paper Water Bottle And Ecological. L'Oréal used Ecologic bottles when launching its eco-friendly personal care line Seed Phytonutrients, including paper shampoo bottles that won't break down in the shower.

Some cosmetic brands are looking at the potential for more creative solutions using materials such asak mushrooms, wood pulp or agar.

Despite the growing interest, it should be noted that companies may face barriers in expanding the use of biodegradable packaging, as its production may not be entirely environmentally friendly.

A typical 90% shampoo bottle is made up of water, and shipping large, water-based products results in significant shipping costs, increased carbon emissions, and increased packaging waste. Removing water from manufacturing and shipping processes is a new focus for beauty brands to make their brands more sustainable.

A number of startups and corporations are developing innovative solutions for concentrating active ingredients in shampoos, soaps and other cosmetic products. Products with reduced water content make them easier to use and are more environmentally friendly. Consumers can switch to “waterless” products, dry shower gels, powder shampoos, chewing toothpastes without changing their habits and daily routine. Many companies are actively working on developing this direction. It is one of the main trends in the development of the beauty industry.

Garnier, a L'Oréal-owned company, launched solid shampoo bars in November 2020. In addition to eliminating plastic containers entirely, these shampoos can reduce environmental impacts by 25 % compared to liquid shampoos.

Startup Susteau (formerly OWA Haircare) has signed a deal with Sephora to begin selling waterless hair care products both online and in the retailer's stores. The products are dry concentrates that need to be mixed with the water you already use in the shower or sink. Susteau Company has filed an application for a patent for his powder shampoo.

Carbon-neutral brand Everist develops water-free hair care concentrates and was founded by former executives from companies such as L'Oréal and Revlon. Everist raised a seed round in January 2021.

Company Humankind has developed a wide range of water-saving products, from toothpaste and mouthwash in tablet form to powder shampoos.

Waterless cosmetics are expected to take an important place on store shelves in the future.

Waterless initiatives are not only about products, but also processes. Some companies offer beauty or hair salons devices that reduce water consumption. Glosslab, for example, has developed a waterless manicure. In order to save water, L'Oréal partnered with a tech startup Gjosa has created a shower device called Water Saver. A special design of the water injection in the shower head ensures the production of droplets with a controlled size and incoming flow rate. L'Oréal plans to roll it out in 10,000 salons in the coming years and says it can save up to 80% of water used for rinsing. L'Oréal acquired minority stake in Gjosa in March 2021

It is becoming critical for cosmetic brands to incorporate lean principles into their business models and operations. Water-saving methods are critical to this process.

Examples of virtual stores on the Obsess platform

Leading retailers have also begun experimenting with AR/VR technologies. In 2021, Gap bought company Draper, and Walmart bought it Zeekit https://zeekit.me , which offer 3D virtual try-on technology. Gap made the acquisition two months after announcing it would close all of its brick-and-mortar stores in the UK and Ireland to focus on e-commerce.

Online shopping using virtual reality may become more widespread as the technology improves and becomes cheaper. Fashion shows in virtual reality are already being broadcast by Victoria's Secret, Tommy Hilfger and other fashion houses.

Augmented reality is coming to both physical stores and mobile devices. Uniqlo's MagicMirrors technology allows customers to see in a mirror how the clothes they try on in the store look in different color variations. https://www.trendhunter.com/trends/uniqlo-magic-mirror.

Augmented Reality Mirror Uniglo

CONVERSE has created The Sampler, an augmented reality app for the Apple iPhone. It allows customers to virtually try on a pair of shoes. You select a pair you like from CONVERSE’s digital catalog, point your iPhone camera at your foot, and see how the shoe fits. You can share the image with your friends on Facebook. And if the shoes fit, you can click the “Buy Now” button.

CONVERSE mobile app

Allbirds uses similar augmented reality technology to offer at-home try-ons through its app. Amazon also offers virtual try-ons for shoes, clothes, and style searches based on uploaded photos.

Social media is actively promoting shopping using VR and AR. In January 2022, Snapchat Snap updated its AR Shopping Lenses to include a description of the displayed product, price, and a link to buy — all of which appear next to an image of a customer “trying on” the item.

Now, any company can upload their product catalog to Snapchat and let users use virtual try-on with links to buy. Snapchat also gives companies access to real-time analytics on their products. And the ability to share try-on results with friends helps expand the target audience and increase sales.

The ability to use an uploaded photo of an outfit you like to search for similar items from suppliers, or the so-called digital stylist feature, is gaining popularity as a new way to find what to buy.

Amazon began offering the feature, StyleSnap, in 2019 for clothing items, and has since expanded it to furniture and home furnishings.

Google Lens allows users to upload photos of fashion items they like and then search for similar items online. Facebook has been experimenting with its own AI system called Fashion++. The software uses AI to analyze clothing and suggest changes it thinks might improve the look (like rolling up the sleeves).

Leading fashion houses are also testing digital stylists in select markets: Prada, for example, has introduced a “personalized concierge” chatbot for its Chinese website.

The demand for digital stylists from retailers has created the conditions for the development of technology platforms in this area.

Israeli company Site offers suppliers and retailers a camera button that can be placed next to the search bar on a website or mobile app. It allows shoppers to upload images of their favorite styles and then see looks “inspired” by those images in the store. The platform also offers site visitor analytics and a program to optimize the user experience. The platform counts a number of leading brands among its clients, including Tommy Hilfger, Myntra, and Kohl’s.

British company Snap Vision also offers a range of visual search tools for retailers and influencers. These tools allow you to turn iOS and Android apps into visual search tools.

Singapore startup ViSenze AI created a visual recognition tool that “deconstructs” uploaded photos, making it easier to discover, search, and buy relevant items. ViSenze’s clients include well-known brands including Myntra and Urban Outftters.

Similar technologies are also finding application in the art market. For example, Thread Genius Inc. offers special software that allows you to search for similar art objects at auctions by image. Thread Genius was acquired by Sotheby's in 2018, which allowed the company increase sales through an online platform.

During recessions and economic downturns, such as the Covid-19 crisis, beauty tends to remain a resilient category due to the so-called “lipstick effect” – the tendency of consumers to view beauty as an affordable, nice little luxury in uncertain economic times. Price is one of the most powerful drivers of consumer engagement. Therefore, pricing strategy and price portfolio management are of great importance. Attractive prices and transparent and fair pricing attract consumer attention and are perceived positively.

Let's look at some examples of business models built on differentiated pricing. The company Deciem is able to keep prices low by focusing on high-quality ingredients that are widely produced around the world and therefore have optimal prices. One of its brands is a line of cosmetics The Ordinary, offering high-quality cosmetics at low prices. The beauty industry has worked hard to convince consumers that the high prices of premium creams and serums are justified. However, these prices are more due to markups than to the cost of special premium ingredients. But due to the established positioning of such products, The Ordinary's low prices were initially met with skepticism by consumers. Deciem aims to overcome this prejudice by positioning its products as medical substances. "If you had a headache and saw one bottle of aspirin for two dollars and another one for two hundred dollars, you would never spend the two hundred. Why would you? Despite the low price, you are confident that the two-dollar aspirin will just as well relieve your headache," - says Nicola Kilner, co-CEO of Deciem. Deciem nearly doubled its sales in 2020. The Ordinary became a cult brand. And in February 2021, Estée Lauder acquired a majority stake in Deciem.

Another example: In the few years since its launch in 2016, Perfect Diary has become one of the most popular cosmetics brands on Chinese social media, successfully competing with established players such as L'Oréal and Estée Lauder. The company produces their products in the same factories that work with major, respected luxury brands such as YSL and Dior.

Diversifying product ranges across multiple price points helps companies survive periods of economic instability. Cosmetic brands and conglomerates will increasingly use different pricing strategies to appeal to a wider range of consumers in order to remain an integral part of their daily lives.

Plastic bottles, bags, coffee grounds, discarded textiles - some small and independent companies build their business on recycling various waste and using it to make clothing.

Well-known brands have also announced new clothing lines and initiatives focused on recycled materials. H&M has committed to using only recycled or climate-neutral materials by 2030.

Levi's Wellthread x Outerknown collection tests products made from cotton hemp. The company's jackets feature removable zippers to make them easier to recycle. Processing hemp crops uses significantly less water than organic cotton.

To solve the problem of the material's rough structure, the company created a "cottonization" process that softens the fiber using very little energy or chemical treatment. The resulting fiber is almost indistinguishable from regular cotton. The company also created the Water

In 2019, Adidas launched Futurecraft.Loop, a line of 100% recyclable sneakers. The company also planned to use recycled plastic waste to make shoes.

For fashion companies looking to work with sustainable processes, the company Circular offers a dedicated raw materials library. It is the first digital showcase of fabrics, yarns, trims, leathers and leather alternatives that have been tested and verified for future recyclability.

However, the recycling process also creates secondary pollution and consumes huge amounts of water and energy resources. Recognizing this, the Hong Kong Textile and Clothing Research Institute, with support from the H&M Foundation, has created Green Machine, a recycling system that uses a biodegradable chemical, heat, and water (along with pressure) in a closed loop, eliminating any waste at all. Such machines are used in Indonesia and Turkey and will be deployed in Cambodia in 2022.

The shift to more sustainable materials and processes isn’t the only way the fashion industry is moving towards ethical business. Instead, some startups are developing new types of textiles.

Alternative materials such as plant-based, lab-grown leather could play a big role in making the fashion industry more sustainable.

There are many efforts being made in this area. For example, Modern Meadow, an American biotechnology company, ferments special types of yeast to grow collagen, one of the main components of normal leather, and then processes the resulting protein to create leather material.

Bolt Threads produces a leather fabric called Mylo and a silk fabric called Microsilk.

Bolt has attracted interest from a number of fashion and retail brands and has collaborated with Stella McCartney, Adidas and Lululemon on fashion collections.

The ultimate goal of the sustainable clothing trend is to extend the life of clothing as much as possible and to completely recycle it instead of producing new textiles. Its long-term solution requires the creation of a closed loop, which means that the entire supply chain must be reconsidered accordingly. As new technologies and business models develop, the fashion industry is gradually moving in this direction.

Innovative technologies are playing an increasingly important role in the beauty industry. Leading technology companies that own search engines, artificial intelligence systems, e-commerce platforms, and offer smart home devices have ample opportunity to profit from the beauty market. And they are becoming active players in this market. For example, Amazon created a specialized store of cosmetic products, which sells products and equipment for beauty salons and hairdressers. The company even opened a regular physical hairdresser to demonstrate its technology. Google works with many cosmetic brands, providing them with consumer behavior analytics to effectively monitor the dynamics of their preferences. Sales of cosmetic products on streaming platforms are gaining popularity. Influencers on Instagram, TickTock, Alibaba gather audiences of millions.

There are several key areas where the integration of tech giants and the beauty market is occurring.

ONLINE COSMETICS RETAIL CHANNELS

Amazon has made significant strides in expanding its beauty retail channel. In 2019, the company launched its own beauty brand called Belei and recently invested in an Indian beauty site MyGlammIn addition to its traditional e-commerce site, Amazon also sells beauty products on its online grocery platforms Amazon Fresh and Whole Foods — sales channels that have seen a major boost during the pandemic. They allow the company to cross-sell beauty products alongside its customers’ regular orders.

Instagram has become an influential platform in the beauty industry. It is well suited to growing sales of beauty products, which are visual in nature, rely on peer recommendations, and have a relatively low barrier to entry for newcomers. In 2019, the company launched a shopping feature, later adding augmented reality sales, subscriptions for new product information, and live sales.

LIVE SALES GAIN POPULARITY

Instagram isn’t the only company to use video to sell beauty products. Live streaming of product demonstrations, during which viewers can purchase the products on display, offers a new way to attract a younger audience and increase sales. The approach has already gained huge popularity in Asia, and is quickly spreading to the US and European markets.

Chinese tech giant Alibaba offers live streaming and augmented reality features that have attracted premium beauty brands to the platform.

It’s worth dwelling on the role of influencers in driving sales of beauty products. The KOL (Key Opinion Leaders) category plays a huge role in this market. For example, the “lipstick king” Jiaqi Li attracted millions of viewers every month. His career began in 2015 in the southeastern Chinese province of Jiangxi, where Li, then 23, became a beauty consultant at a L’Oréal cosmetics department in a shopping mall. Soon after Li started working, he noticed that few customers were willing to test lipstick on themselves, so he decided to show customers what it looked like on his own lips. The experiment made him a superstar. Customers loved Li’s work, and he subsequently won the title of best seller in his region several times. Then, when online sales began to develop in China, Li seized the opportunity. In 2018, he broke the Guinness World Record for “most lipstick applications in 30 seconds” during a live webcast on Taobao. Li has enjoyed immense popularity on Chinese online platforms. He has amassed nearly 45 million followers on Douyin, the Chinese version of TikTok, and his net worth is estimated at over 100 million yuan. It should be noted that as of June 3, 2022, Li stopped broadcasting. Presumably for political reasons.

The activity and popularity of influencers is fertile ground for the development of new startups, including those specializing in the beauty market. For example, the company Zamface is developing an online platform for streaming beauty videos. It allows users to find makeup videos based on their appearance, and also provides recommendations for beauty products. The platform allows users to attend makeup tutorials and provides them with tools to create their own videos, including virtual try-on and other necessary features.

VOICE ASSISTANTS BRING BEAUTY TO THE SMART HOME

Voice assistants like Amazon’s Alexa and Apple’s Siri are also opening up new potential for merging technology and beauty. Amazon, Apple, and Google are all offering voice-controlled smart speakers and are planning to deeply integrate their virtual assistants into people’s homes. At the same time, beauty companies are looking to incorporate voice-based shopping into their sales channels. Sephora, for example, has partnered with Google to offer its own Google Assistant app that lets users order products, get skincare tips, and watch Sephora videos on YouTube.

As the smart home concept continues to grow in popularity, beauty brands will need to think about how they can use technology to solve consumer problems, from personalized recommendations to convenient salon and spa appointment bookings. As the beauty industry expands its use of innovative technologies, the opportunities for tech companies to monetize their data, platforms, and devices will grow. However, this does not preclude competition between tech giants and beauty industry leaders, as well as the emergence of new players, platforms, and business models at the intersection of technology innovation and the beauty industry.

Virtual try-on technology uses augmented reality to allow shoppers to see how they would look using different beauty products — without having to reach for makeup remover wipes afterwards. The technology has been around for a few years, and the Covid-19 pandemic has further cemented its place in the beauty industry, allowing customers to safely choose the right product from the comfort of their own home.

In cosmetics retail, virtual try-on technology serves a dual purpose: by combining augmented reality and computer vision, it allows shoppers to virtually try on different looks while simultaneously collecting data on consumer preferences. Virtual try-on is also a tool for personalizing the cosmetics shopping experience, making it easier to find products and receive personalized recommendations.

ModiFace — is one of the most widely used platforms for virtual cosmetics try-on, used by companies from L'Oréal to Smashbox And Benefit CosmeticsModiFace was acquired by L'Oréal in 2018, and social media platforms like Facebook and Youtube have integrated virtual try-on experiences of its cosmetics into influencer ads and videos.

In December 2020, Google partnered with brands like L'Oréal, Estée Lauder, MAC Cosmetics, and more to launch a virtual makeup try-on tool powered by augmented reality. Users can now try on discovered makeup products using their mobile phone camera.

Another leader in virtual fitting applications, along with ModiFace, is the Taiwanese company Perfect Corp. Its technology is used by a variety of beauty and technology platforms. Back in 2017, the company established itself as a provider of augmented reality apps for the beauty market. It subsequently expanded its app capabilities using 3D Face AR technology. This expanded the types of beauty products that users could virtually try on. The app AI Skin Diagnostic uses AI-powered algorithms to analyze the user's skin for a variety of parameters, including wrinkles, redness, oiliness, texture and more, and provides personalized skincare product recommendations.

Company positions itself as “a leading provider of AI and AR SaaS business solutions for beauty and fashion.” It claims to push the boundaries of technology and offers results-oriented, interactive and sustainable Metaverse-ready solutions that can be easily integrated into any brand’s website or apps, as well as across a variety of social media channels including Instagram, Snapchat, YouTube and many more.”

There has been a surge in activity in the area of virtual try-on apps for cosmetics lately. For example, the company IT Cosmetics entered into a partnership agreement with Skin Match Technology. The latter offers tools that provide transparency of product content, personalized service, and ingredients in a brand-friendly form. By collecting and combining detailed information about products, ingredients, and consumer needs, the company also forms an extensive database of consumer preferences. In March 2021, IT Cosmetics introduced its customers Skin Match recommendation technology by shade of foundation based on artificial intelligence.

In April 2021, the biotech company Amyris one of the leaders in the production of synthetic ingredients acquired company Beauty Labs, a developer of AI-powered apps for beauty brands. Beauty Labs, a machine learning technology company, has developed one of the leading consumer apps for color cosmetics that uses the principle of “try before you buy.” The technology uses the power of machine learning and AI technology to match a palette of beauty products to your skin tone. Beauty Labs also develops advanced software that assesses skin condition, provides personalized product recommendations for improving skin health, as well as online sales and interactive education tools.

Virtual try-ons are also being used for hair color and manicure. According to Sally Beauty’s director of merchandising Pam Cohn, hair color has increased significantly over the past year as quarantine has prompted new forms of self-expression. For example, hair color company Madison Reed, offers virtual try-on on its website, allowing customers to experiment with different styles without leaving home. And the company's On Hand app, powered by ModiFace, Essie virtually tries on nail polish. The Brow app by Anastasia Beverly Hills allows users to choose the shape and color of their eyebrows.

As people spend more time working and socializing virtually, video filters could prove to be another growing market segment. In 2020, L'Oréal launched Signature Faces, a line of “virtual makeup products.” The line includes makeup filters supported by a number of platforms, including Zoom, Instagram, Snapchat, and more.

Virtual try-on, of course, cannot completely replace the interaction with a sales representative in a store, the feeling of skin contact and the texture of physical products. However, the development trends of online sales channels, social networks and virtual worlds provide it with a reliable position in the world of beauty. In addition, virtual try-on is an important source of information about consumer preferences, which is critical for the development of personalized cosmetic product offerings.

Today’s consumers want to know what’s in the products they consume. They care not only about the quality of ingredients, but also how they’re sourced and processed. That’s why ingredient transparency has become a top priority not only for beauty and personal care brands, but also for other consumer product companies. Companies like Unilever, P&G, and Target are jumping on this bandwagon through acquisitions, startup accelerators, and their own corporate incubators.

One of the most prominent manifestations of this trend has been the “clean beauty” movement, which suggests that the base ingredients of cosmetic products are natural and organic products. However, the lack of a clear legal definition of terms like “natural” and “clean” leads to some confusion about their meaning. And consumers are increasingly aware that not all “natural” ingredients are good for you — and not all synthetic products are bad. As a result, companies are shifting their focus from using natural ingredients to providing detailed information to consumers about the ingredients they use in their production. Companies are looking to use substances whose effectiveness and safety are confirmed by scientific methods or by the authority of doctors and clinical experts. Some cosmetic brands conduct clinical studies to test their products, posting the results of clinical and laboratory studies of patients on their websites. For example, such information can be found on the corporate websites of companies Juice Beauty And ZO Skin Health

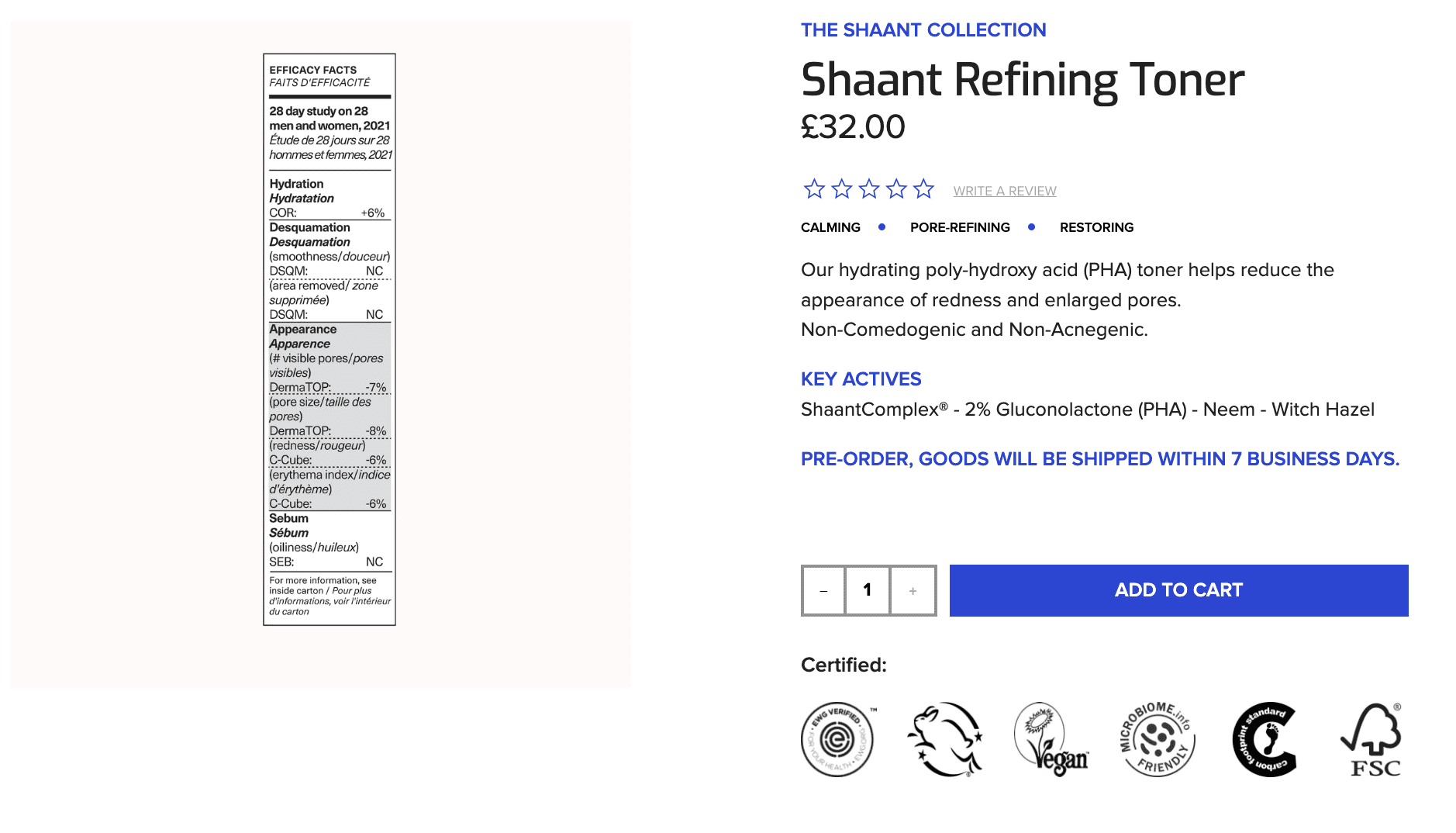

Other companies are including clinical results in their product labels. In February 2021, cosmetics biotech company Codex Beauty Labs announced a new labeling strategies, which will disclose clinical efficacy data on the packaging of all its skin care products, including performance ratings for hydration, firmness, oiliness and more.

To prove the effectiveness of their products and services beyond medical endorsements and scientific studies, beauty stakeholders — from brands to dermatologists and makeup artists — are using social media to educate and engage users. TikTok is currently one of the most used platforms for this purpose.

Disclosure of the ingredients in cosmetics means not only explaining what ingredients they contain and how effective they are. It also means providing detailed information about how these ingredients are sourced and processed. It is known that the sources of ingredients and the formulas of cosmetics have always been a trade secret, closely guarded by cosmetic companies. But today, supply chain transparency helps brands stand out from the competition. And it is possible that this trend may turn from a special case into an indispensable requirement for a company’s work in the market in the future. In the future, the beauty industry will stop playing with empty buzzwords like “clean” and “natural” and instead will disclose full information about specific ingredients, their safety and effectiveness.

Lil Miquela's Instagram account shows that a computer-generated model can become an influencer — as of March 2022, the account has 3 million followers. The model wears Prada, has worked with fashion magazines, and has appeared alongside real models in advertisements.

During the height of the Covid-19 pandemic, visiting spas, hairdressers and beauty salons was far from always available. But thanks to new technologies, beauty services are no longer tied to traditional places. Now consumers can bring the spa right to their home. We are talking about the development of platforms that provide tools for booking procedures, managing visits to specialists, demonstrating their work and accepting payments.

The demand for such services is not limited by geography. For example, the company Glamera, offers spa and make-up services on request, and is based in Egypt. The company's headquarters Urban, which connects users with skincare specialists, nail technicians and other beauty services, is based in the UK. And the company Zenoti provides software products for managing cosmetic and medical services in more than 50 countries.

A number of companies offer a range of care services in their networks, and clients can remotely receive a diagnostic consultation, book an appointment, and see detailed information about specific specialists and procedures. Examples include: Heyday (complex cosmetic services), FaceGym (exercises, tools and preparations for facial gymnastics) and Skin Laundry (laser therapy for skin).

Other companies, on the contrary, send specialists to their clients’ homes or offices. For example, the company Glamsquad offers a full range of services including hairdressing, makeup, manicure, wedding planning and photography services.

Manicures are also increasingly moving from salons to homes. For example, California-based company ManiMe uses 3D scanning and printing technology to create custom false nails, which are then sent to the client.

Chinese company O'2NAILS has created a line of fully automated manicure devices that are designed for both professional salons and home use.

In general, the development of innovative SPA devices for home use is becoming one of the rapidly developing segments of the beauty market. The company Tria Beauty offers laser hair removal and light skin treatment products that consumers can use on their own without the help of a professional. The company Foreo sells devices for facial massage, blue light acne treatment, and at-home microcurrent facelifts. And the company LightStim offers products that use multiple wavelengths of light to treat acne and reduce wrinkles.