IF YOU ARE GOING TO INVEST OR ATTRACT INVESTMENTS

After a challenging 2022, there was little reason to believe that 2023 would be a more robust year for tech, startups and venture capital. During the first six months of 2023, these fears were confirmed. Between the crypto apocalypse, mass layoffs, the banking crisis and, yes, the never-ending buzz around artificial intelligence (AI), the first half of the year has been challenging for venture capital firms and startups.

The year began with what many people are still trying to wrap their minds around—one of the biggest bubble bursts since 2000: the collapse of crypto exchange FTX.

FTX and FTX US, its US-based exchange, were valued at $32 billion and $8 billion respectively and were backed by major venture capital firms including Sequoia Capital, NEA, Lightspeed Venture Partners, Insight Partners, Temasek, SoftBank. Vision Fund, Thoma Bravo, SoftBank Vision Fund 2 and Coinbase Ventures.

However, despite the troubles plaguing the industry—several startups filed for bankruptcy and/or announced mass layoffs—the year began with significant increases in cryptocurrency prices, with Ethereum and Bitcoin rising by more than 50%. The unexpected surge seemed to buoy the industry somewhat, with many seeing it as a sign of the sustainability of cryptocurrency, blockchain and all things Web3.

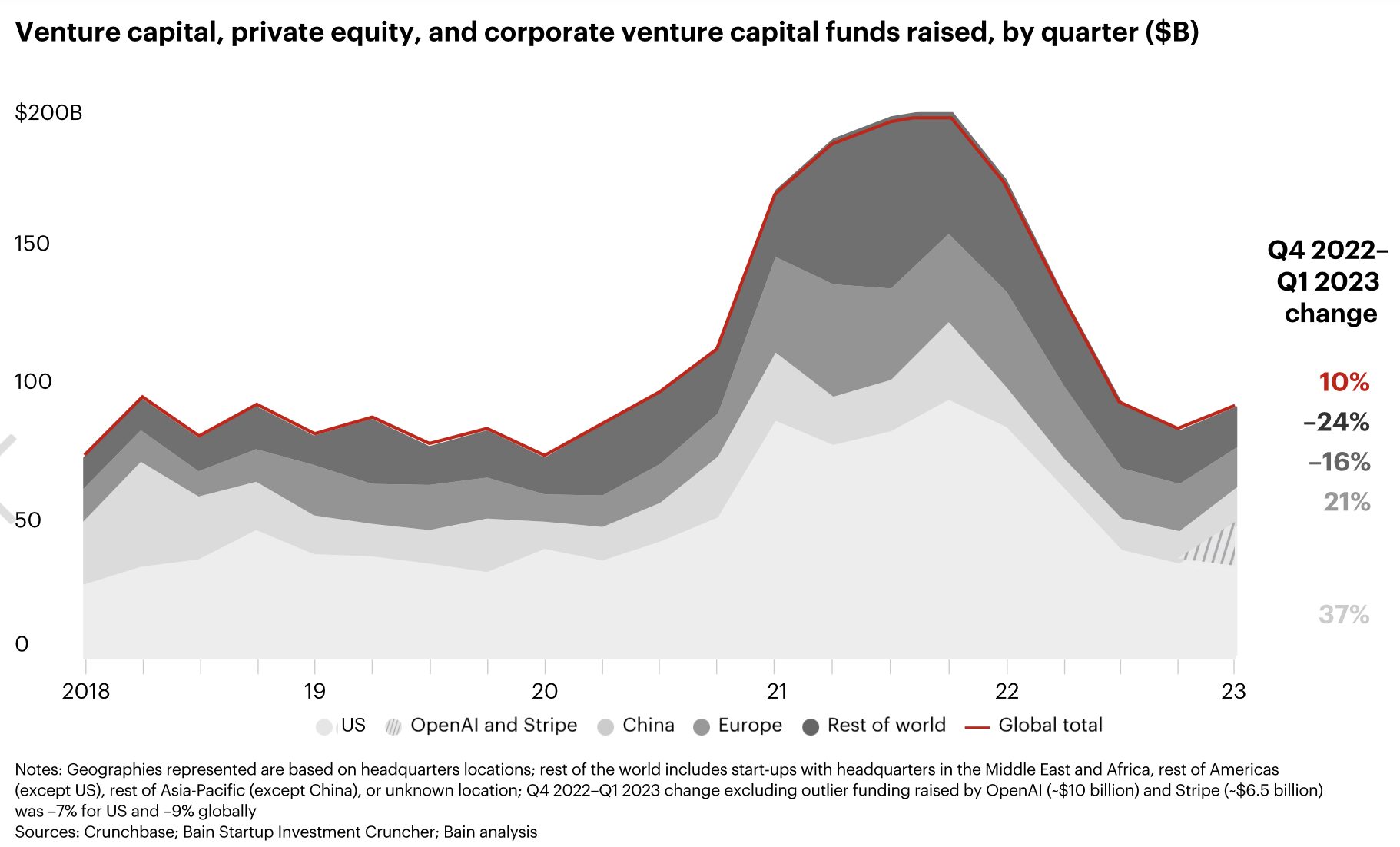

But there was no particular optimism on the part of venture investors. The slowdown in investment, which began as early as 2022, is likely to last until the end of 2023.

Data from Crunchbase at the start of 2023 showed that global venture capital investment in the sector in 2022 fell by 35% compared to 2021 to about $445 billion. While this is still an impressive number, it pales in comparison to the $681 billion invested in 2021. Unfortunately, current indicators show no signs of recovering to these levels.

But if there is anything that could save the picture, it became obvious early in the year that it was artificial intelligence - a new sector for active venture investment.

The AI craze began in late 2022 with Stability AI, a London startup offering AI solutions for image processing, Descript, an AI video and audio editing tool based in San Francisco, and an AI content creation platform based in Austin, Texas. ,Jasper has received significant investment.

Next, interest in AI startups spread like wildfire. At the very beginning of 2023, it became known that OpenAI, the company that developed ChatGPT and DALL-E, is valued at $29 billion and is ready to attract venture capital investments.

By the end of January, Microsoft had confirmed a "multi-year, multi-billion dollar investment" in OpenAI. Although the exact dollar amount was not confirmed, the same month it was reported that Microsoft was in talks to invest up to $10 billion.

Following this, there was a breakthrough in AI investment. Dozens of startups in the sector—or at least claiming to use AI—have raised billions of dollars.

Among the largest transactions are:

- $450 million to Anthropic, a ChatGPT competitor with its AI assistant Claude, at a $5 billion valuation.

- $270 million into startup Cohere in June, valuing the company at $2.2 billion.

- $350 million in Adept AI at a valuation of approximately $1 billion.

Large corporations, almost all have demonstrated interest in AI. Among them are Microsoft, Google, Zoom Ventures, Nvidia, Oracle and Salesforce Ventures.

Interest in investments in this area is likely to continue into the second half of 2023. Although it should be noted that the euphoria in the field of AI will still be overshadowed by trends in government regulation of this area due to the possible impact of AI on everything from jobs to the economy, data privacy and even mental health.

On March 9, Silicon Valley Bank, which had relationships with more than half of all U.S. venture capital firms, saw its stock price fall after it announced it would sell $2.25 billion in shares to shore up its balance sheet.

Despite the bank's efforts to reassure its clients that everything was fine, the announcement rocked the venture capital world and raised concerns about the bank's liquidity and sustainability.

Customers rushed to withdraw their deposits in droves, which quickly led to a massive outflow of funds and the sad end of a bank that had been a staple for venture capital-backed startups for the past 40 years. His clients included companies such as Cisco Systems and Bay Networks.

SVB's collapse was partly due to the downturn in the venture capital market. Due to rising interest rates, investments have declined and startup deposits have dwindled. SVB simultaneously made the disastrous decision to invest in longer-term, higher-yielding bonds, which further reduced its liquidity.

On March 26, the Federal Deposit Insurance Corporation announced that First Citizens BancShares had agreed to buy the loans and deposits of bankrupt SVB.

The Federal Reserve Board report said the collapse was a "textbook case of mismanagement on the part of the bank" and that when the bank's board and management realized their risk, they did not take appropriate steps to quickly address the problems.

Days after regulators released a report on Silicon Valley Bank's historic collapse, First Republic Bank, which also had a significant number of startups among its clients, also found itself in trouble and was quickly sold to JPMorgan Chase.

The bankruptcies of the two largest American banks, First Republic and SVB, have changed and, most likely, will continue to influence the structure of sources of financing for startups, including negatively affecting the dynamics of the venture capital market.

As money has become tighter in tech, one of the recurring themes of last year and throughout the first half of this year has been layoffs.

Since the start of the year, about 150,000 workers at U.S. tech companies—or tech companies with large U.S. employees—have been laid off in massive job cuts, according to Crunchbase News' Tech Layoffs Tracker.

These layoffs occurred everywhere from well-known public companies including Alphabet, Oracle and Coinbase to startups such as Pendo and Reddit.

Under these circumstances, job cuts should not come as a surprise. It is likely that they will continue in the second half of the year. Venture capital giants, including Andreessen Horowitz, Tiger Global, Khosla Ventures, Insight Partners and many others, have significantly slowed the pace of their investments.

In the second half, startups will likely also struggle to secure venture capital investment. Although SoftBank founder Masayoshi Son only recently told investors that the company's Vision Fund unit will return to "attack mode" and hope to lead the AI revolution.

Thus, it seems that only the field of artificial intelligence will be able to bring investors back to investing heavily in startups. At the same time, the emphasis in investing in public companies has clearly shifted to conservative indicators of profitability and stable cash flows, rather than forecasts of high growth and high valuations of startups based on this.

However, it is worth noting that in the face of layoffs, rising bank rates and numerous crises, the venture capital sector and technology startups have demonstrated surprising resilience. It is likely that these trends will continue in the second half of 2023.